Euro area (changing composition), Eurosystem reporting sector - Base money [sum(L010000 and L020100 and L020200)], Euro - World not allocated (geographically) counterpart - Quick View - ECB Statistical Data Warehouse

The ECB's policy of printing money will not lead to wealth creation. Instead, it will inevitably lead to inflation far above 6% across Europe. | EUROPP

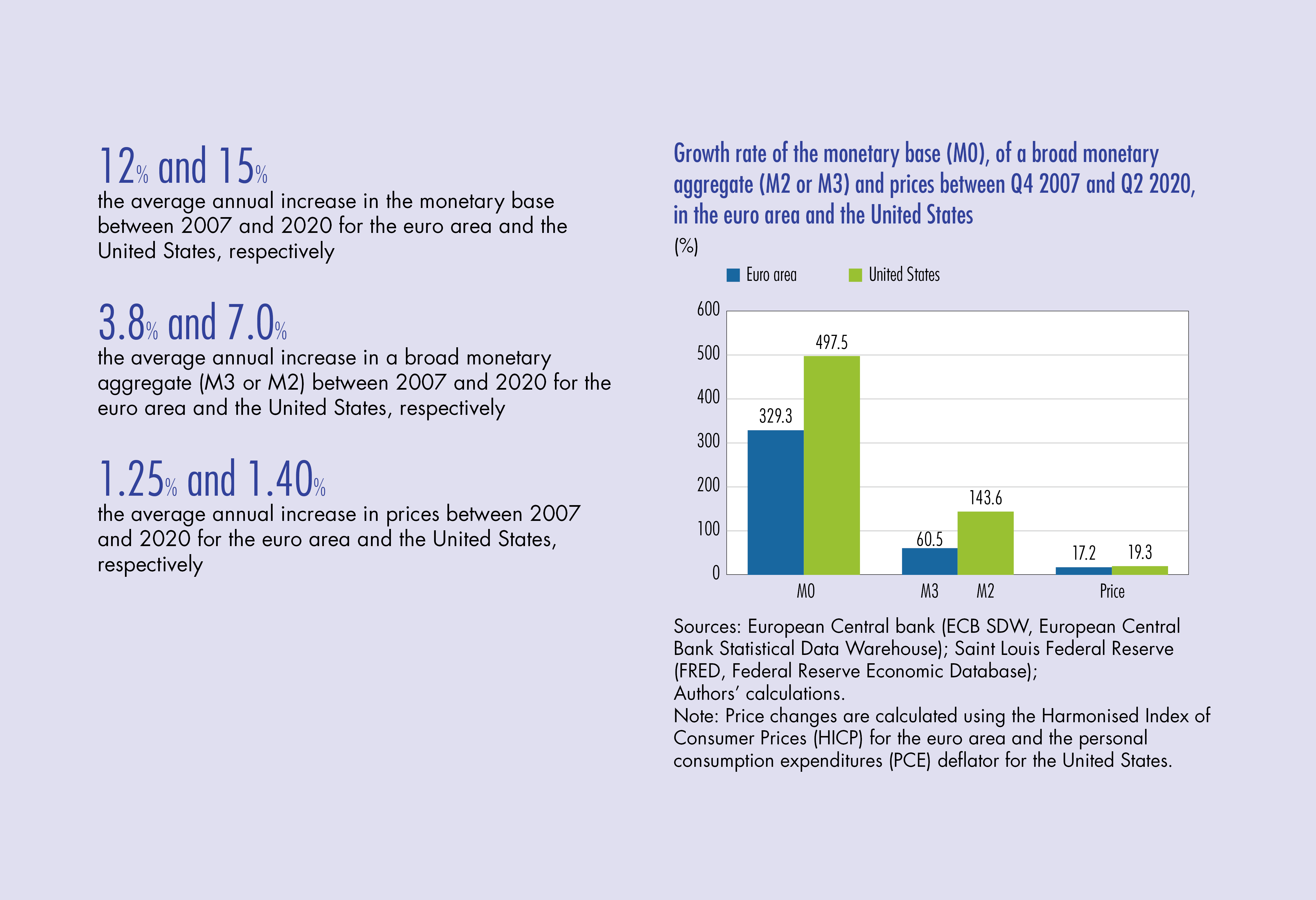

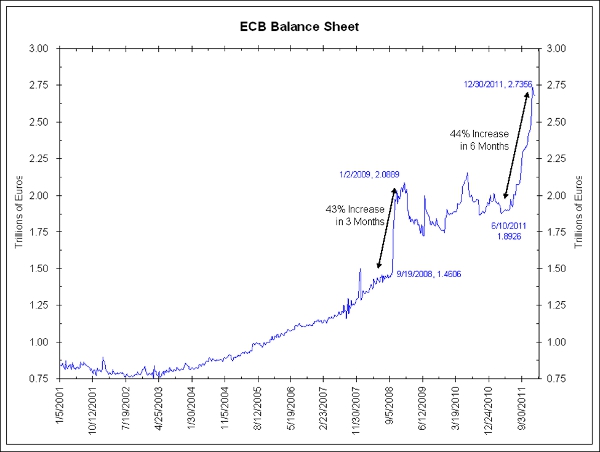

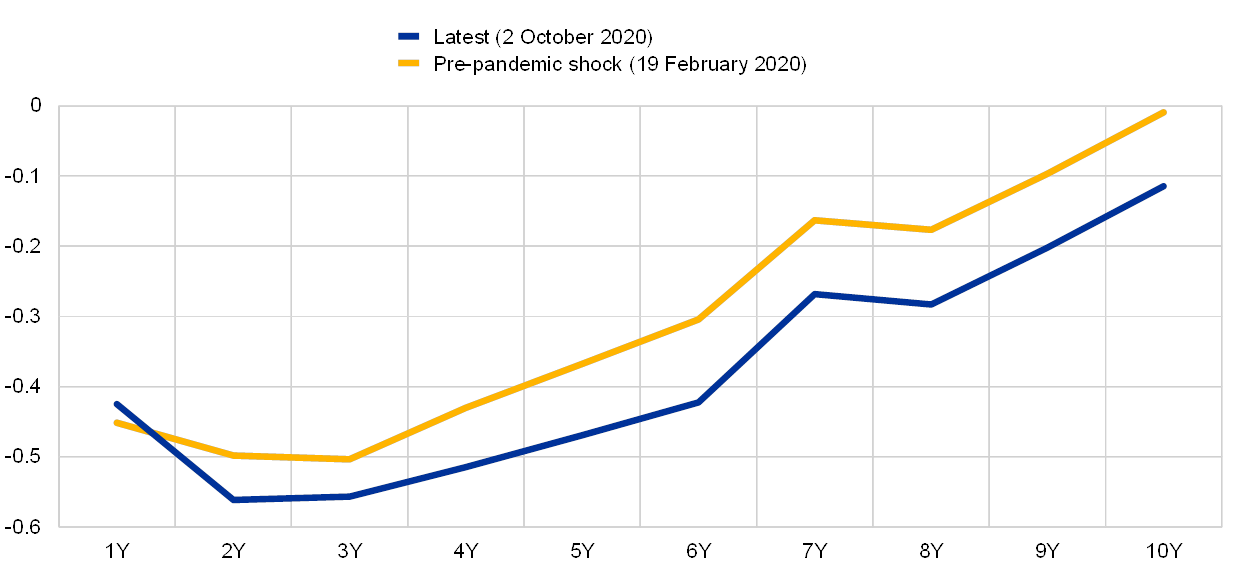

Eurozone in times of Covid-19: Debt monetisation by stealth, SUERF Policy Brief .:. SUERF - The European Money and Finance Forum

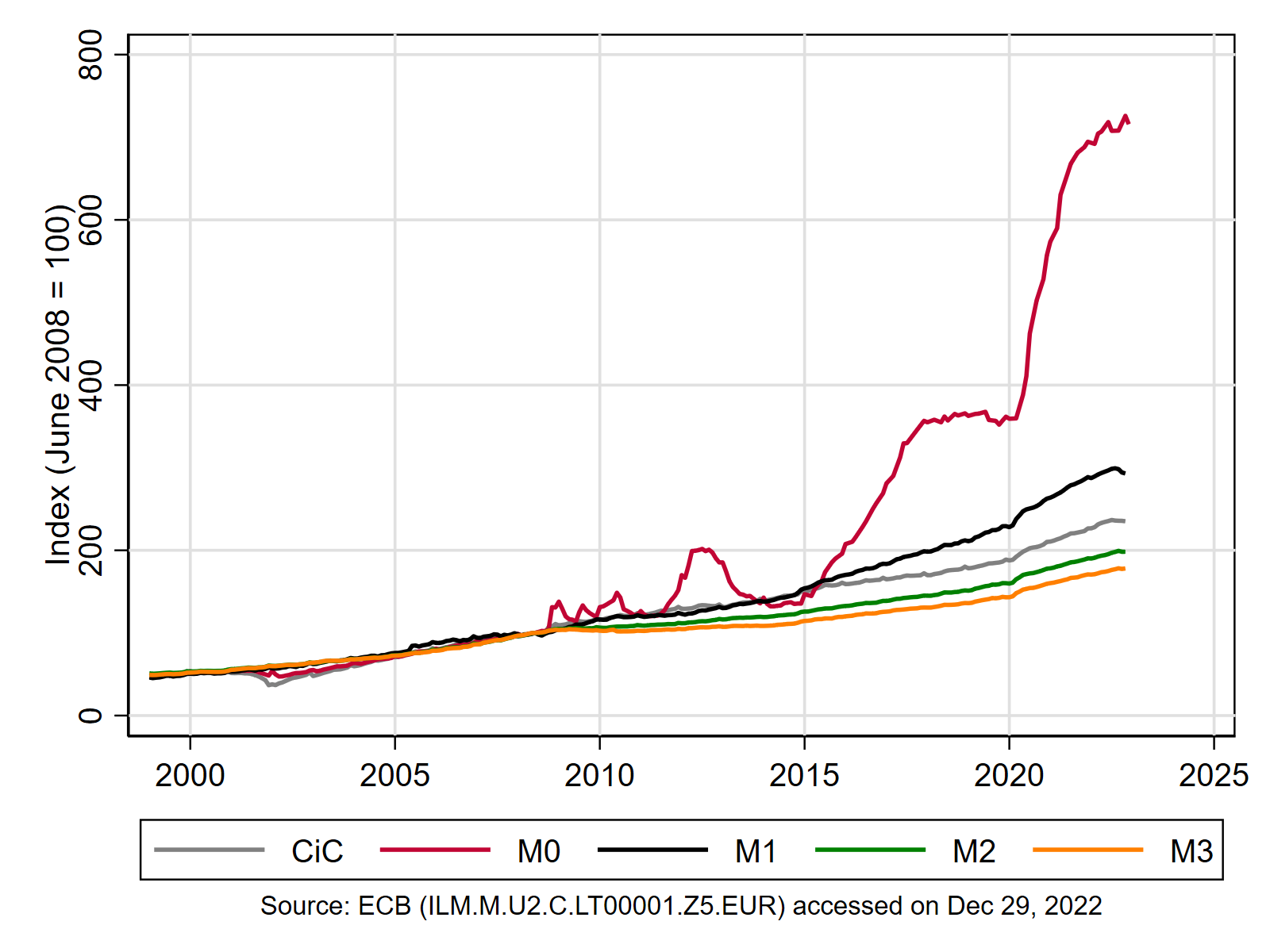

Eric Dor on Twitter: "It is often wrongly claimed that assets purchases by the #ECB massively increase the stock of #money circulating in the euro area Such a claim is a mistake. #

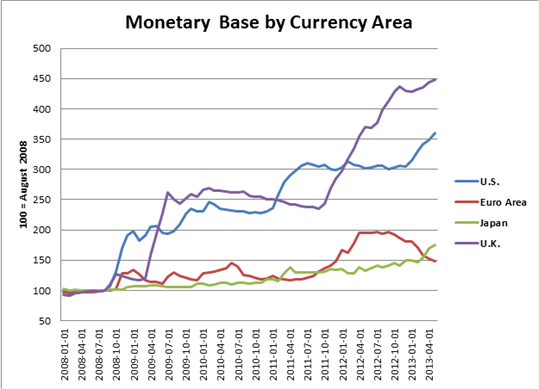

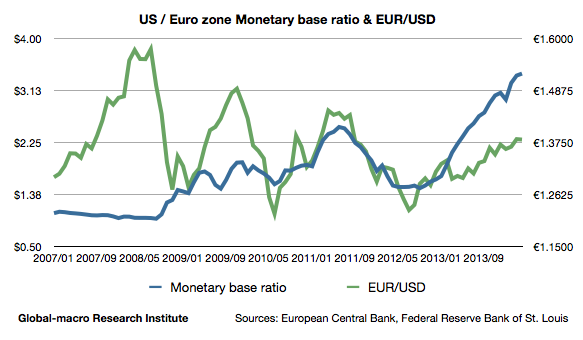

Richard Koo´s misleading take on the great recession: The final chapter – a guest post by Mark Sadowski snbchf.com

/graphics.reuters.com/EUROZONE-MARKETS/ECB/lgvdwzngepo/chart.png_2.jpg)